Family trusts are very effective and convenient, and if used prudently can be a great tool not only for succession planning, but also for managing assets, finances and investing in securities and utilising the returns earned by the trust for the benefit of the beneficiaries. A family trust as the name suggests is a vehicle independent of its author or the beneficiaries and therefore enjoys a relatively permanent nature and greater flexibility in terms of managing the assets held in the trust in terms of investing, acquiring, disposing and otherwise dealing with the assets of the trust.

A family trust can also be utilised to provide for specific needs of the family, say education or health or travel or marriage and in itself act as a vehicle which holds assets only for that specific purpose, multiplying, safeguarding, managing and securing them for that outlined purpose. A family trust can be very effective in case differently abled family members. A private family trust can offer high degree of protection and the desired flexibility at the same time.

Advantages of Private Family Trust:

- Provision for lifetime for all the Beneficiaries

- To ring fence personal assets from any future potential risks arising out of senior corporate responsibilities, actions and decisions.

- To fulfill the goal of Asset protection Planning, i.e. to insulate Assets from any claims

- Smooth transfer of Assets to the Beneficiaries

- Insulating Assets against any litigation in future from within or outside the Family

- Provision in the Trust to take care of daily maintenance, medical emergencies and facilities of all the beneficiaries during their lifetime.

- Setting a framework/guideline on investment decision and portfolio management.

- Making provision for long term and ongoing charity.

- Minimum hassle and paperwork for the Beneficiaries

- Provision against Critical illness or any medical emergencies

- To Plan effectively to avoid loss of wealth base for future generation when Inheritance Tax is imposed by the Government.

- Contingencies like sudden death, incapacitation to be taken care.

- No family member to be burdened with paperwork, taxation and execution related activities.

- To eliminate Probate process as it will help in saving a great amount of legal formalities, legislative fees and delays.

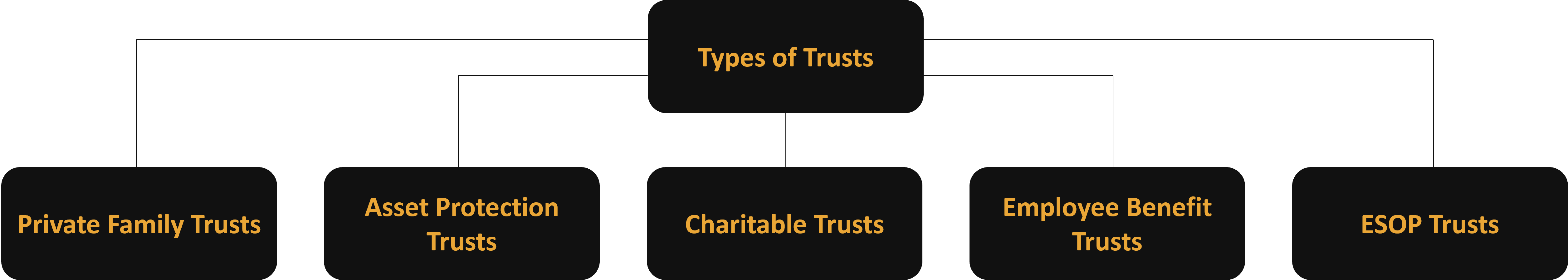

What Is an Asset Protection Trust (APT)?

An asset protection trust (APT) is a financial-planning trust vehicle that holds an individual’s assets with the purpose of shielding them from creditors. Asset protection trusts offer the strongest protection you can find from creditors, lawsuits, or any judgments against your estate. An APT can even help deter costly litigation before it begins, or it can influence outcomes of settlement negotiations favourably.

The creditor and regulator risks are not only applicable to entrepreneurs but also senior executives or professionals. Director of a company (including the independent director) are exposed to corporate action triggered risks.

When should one consider

- When entrepreneurs are giving or have given personal guarantee

- When the entrepreneurs borrow heavily for businesses expansion

- Liabilities that can arise in capacity of a Director.

- Individuals facing divorce.

- Entrepreneurs in the regulated business space

- An asset protection trust (APT) is a complex financial-planning tool designed to protect your assets from creditors.

- APTs offer the strongest protection you can find from creditors, lawsuits, or judgments against your estate.

- These vehicles are structured as either “domestic” or “foreign” asset protection trusts.

An Employee Benefit Trust (EBT) is a discretionary trust established for the benefit of employees of a company (or a group of companies). Through Employee Stock Option Plans (ESOP), Corporates can encourage Employees to participate in the ownership of the company. ESOP trusts facilitate this process.

An Employee Welfare Trusts (EWT) are established to cater to employee welfare needs such as funding child education, medical expenses and extra ordinary expenses not covered under compensation.

The objects of such Trusts may be all of the following or may be some selective objects, but which are always for the benefit of all employees or for a class of employees. The objectives may be as under.

- Medical Aid to employees or/and their family

- Educational Help to employees or/and their children

- Help to purchase residential house

- For giving prize to an employee who has done extraordinary job for Company

- For arranging Trips, Seminars or training for employees

- For extending retirement gifts to employees etc.

Terentia’s customised services in this area include:

- Review of transaction documents

- Executing of Trust documents and obtaining PAN / TAN

- Opening and operating trust bank / depository / broker accounts

- Undertaking purchase and sale of securities, through appointed broker, in line with pre-approved investment policy

- Implementing benefits application policy

- Recording approvals and maintain trust accounts

- Filing tax returns and ensuring tax compliance

- Reporting and MIS